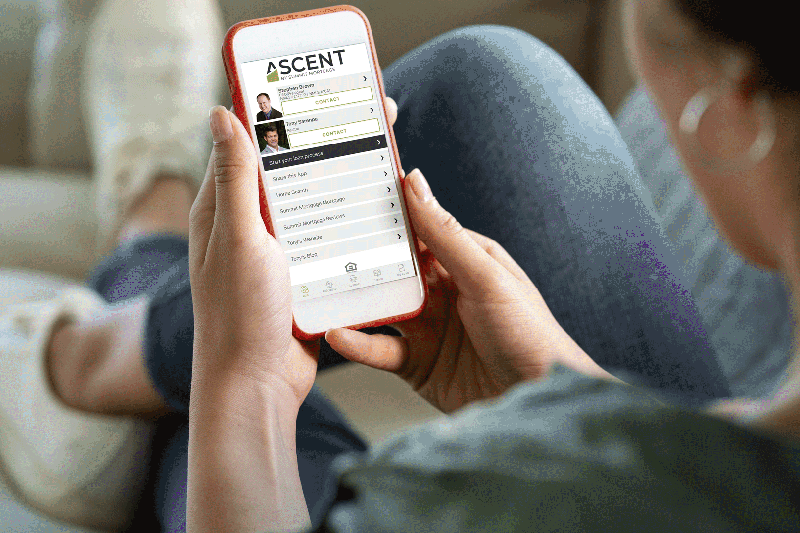

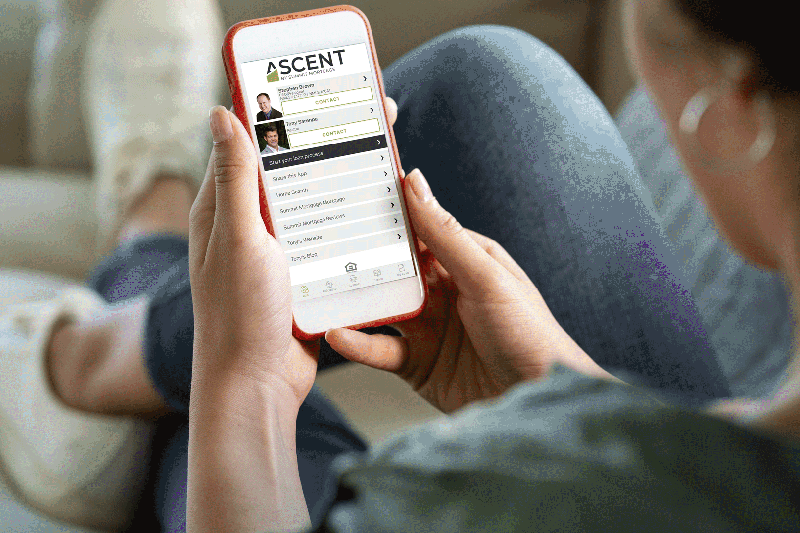

Guiding You Home With The Ascent Mortgage App

Considering buying a home or refinancing your current home? Summit Mortgage Corporation has news you can use. We’ve improved the home loan ...

We believe it’s possible to build a successful company without sacrificing integrity, transparency, or expertise – and we haven’t been wrong yet. Integrity requires transparency and accessibility while expertise is what we obtained as veterans and students of the mortgage industry evidenced by our 30+ years of navigating and thriving in a variety of market conditions. Humility undergirds it all ensuring all other cultural attributes are prioritized.

My wife Diana and I started Summit Mortgage in 1992. We had both been originating mortgage loans and wanted to build our own business that was run from a loan originator’s point-of-view and focused on providing an unparalleled homebuying experience – an endeavor that I’m proud to say remains a hallmark of the company.

I’m active in the mortgage community – having been the president of the Minnesota Mortgage Association, a board member of Lenders One, and a long-time participant in MBA and CMLA.

Before getting started in the mortgage industry, I graduated from Bethany College in West Virginia and received my MBA from the University of Minnesota.

When not involved in the mortgage industry, you can find me on a golf course, on a biking holiday in Europe, or on a ski slope. Philanthropy is also very important to Diana and me, which is why we started a foundation that primarily supports college endowment scholarships and clinical trials that improve healthcare.

Summit Mortgage gives loan officers access to the support and resources of a national lender, while allowing you the freedom and flexibility to manage client relationships your way.

We work with multiple investors, hedge funds, and warehouse lines to deliver the buying power you need, while our in-house operations and marketing teams provide the support you deserve.

Considering buying a home or refinancing your current home? Summit Mortgage Corporation has news you can use. We’ve improved the home loan ...

Rate volatility, new laws, regulations, loan program changes, and lender consolidations have all changed the layout of our industry over the last decade and it doesn't appear that is going ...